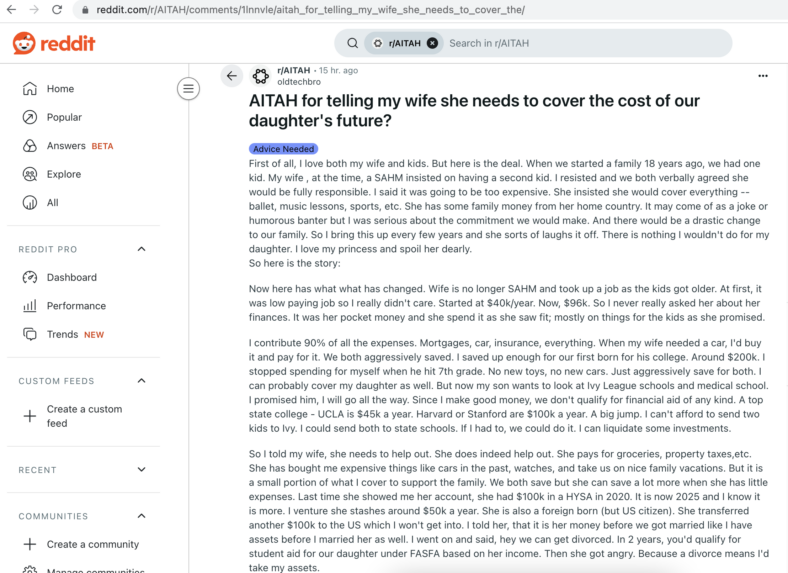

He Told His Wife To Fund Their Daughter’s Future, Or Face The Divorce They Never Planned

After this man and his wife decided to start a family 18 years ago, his wife really wanted a second baby. He was against the idea, too, but in the end, they agreed that if they had two kids, then his wife would be fully financially responsible for their next child.

At the time, his wife was a stay-at-home mom, and he made it clear that providing for their second child alone would be very expensive. She, on the other hand, claimed she’d cover everything from ballet classes to music lessons, since she apparently had some family money.

“It may come off as a joke or humorous banter, but I was serious about the commitment we would make. And there would be a drastic change to our family,” he recalled.

That’s why he brings their agreement up every few years, and his wife normally just laughs it off. However, she’s no longer a stay-at-home mom, and he thinks it’s time for his wife to finally step up.

For some context, she started taking on jobs once their children got older. Her first position was rather low-paying, earning about $40,000 per year, so he didn’t really care about her contributing.

“It was her pocket money and she spent it as she saw fit, mostly on things for the kids, as she promised,” he recalled.

Now, though, his wife takes home $96,000, and he’s currently paying for 90% of their expenses, including their mortgages and car insurance. And since his kids are heading off to college soon, he wants her to help out more.

Back when their first child, his son, entered seventh grade, he supposedly stopped spending money on himself and began aggressively saving for his son’s college fund. He did the same for his second kid, their daughter, and today, he thinks he has enough saved up to cover both of their college tuitions.

The main problem is that his son is currently interested in attending an Ivy League school, as well as pursuing medical school afterward, and he has promised to support his son’s education.

Sign up for Chip Chick’s newsletter and get stories like this delivered to your inbox.

He makes a solid salary, too, meaning that his children will not qualify for any financial aid. Regardless, the jump from a state school to an Ivy League institution is steep. While UCLA would cost about $45,000 a year, it would be $100,000 per year for his son to attend Harvard or Stanford.

“I can’t afford to send two kids to the Ivy League. I could send both to state schools. If I had to, we could do it. I can liquidate some investments,” he reasoned.

But he thinks his wife helping out more would be most beneficial, and he recently told her that. He clarified that his wife does contribute by paying for things like groceries and property taxes. She also takes them on family vacations and has gifted him cars and watches in the past.

Nonetheless, he feels that his wife’s contributions are small in comparison to what he spends on their family. And while they both actively work on saving money, he believes his wife has the ability to save more, given how few expenses she has to cover.

The last time he saw his wife’s high-yield savings account (HYSA) was in 2020, and she had stashed away $100,000. Five years later, he knows that she has more in the account, and he believes she puts away about $50,000 each year.

It’s also worth noting that, despite his wife being a United States citizen, she was born in another country and transferred an additional $100,000 into the U.S.

“I told her that it is her money before we got married, like I had assets before I married her as well. I went on and said, ‘Hey, we can get divorced. In two years, you’d qualify for student aid for our daughter under FAFSA based on your income,” he revealed.

“Then, she got angry, because a divorce means I’d take my assets.”

In the end, he told his wife that they either needed to combine their assets to support both of their children’s futures, or she’d be financially responsible for their daughter, which is the original deal they’d agreed to 18 years ago.

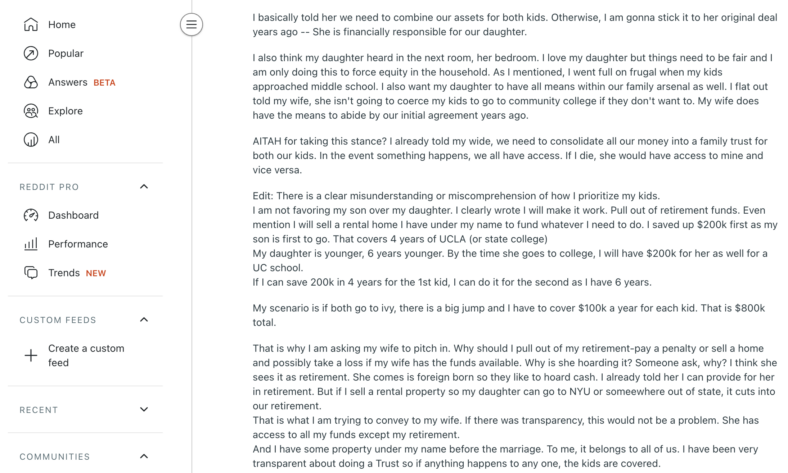

Unfortunately, he suspects that his daughter overheard this conversation from her bedroom. But despite the fact that he loves his daughter, he still wants things to be fair and equitable in their home.

“As I mentioned, I went full-on frugal when my kids approached middle school. I also want my daughter to have all means within our family arsenal as well,” he detailed.

In other words, he told his wife that she couldn’t “coerce” their kids into attending community college if that’s not what they want. And as of right now, she doesn’t have the financial means to follow through on their initial agreement.

That’s why his wife has essentially been backed into a corner over their assets, with him pushing to consolidate all their money into a family trust for both their kids.

“In the event something happens, we all have access. If I die, she would have access to mine, and vice versa,” he explained.

Still, in the wake of their discussion, he’s unsure whether standing firm and telling his wife that she needs to help fund the cost of their daughter’s future is justified or makes him a jerk.

Do you think both parents should always be responsible for supporting their kids? Or should his wife be required to follow through on their agreement from nearly two decades ago? What advice would you give him?

You can read the original post below.

More About:Relationships