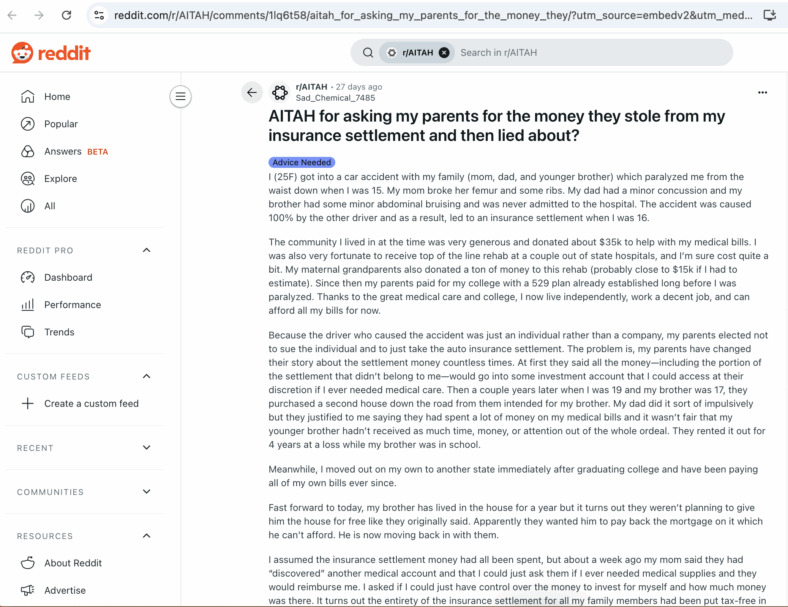

Her Parents Stole Her Settlement Money And Lied About It

Could you imagine getting in a car accident as a teen, suffering paralysis, and receiving an insurance settlement, only to realize nearly a decade later that your parents might’ve stolen the money and lied about it? Tragically, that’s exactly what this 25-year-old woman is going through right now.

Back when she was just 15 years old, she was in a car crash with her parents and younger brother that left her paralyzed from the waist down. As for her relatives, they had less severe injuries. Her dad got a minor concussion, her mom had some broken ribs and a broken femur, and her brother only had minor abdominal bruising.

The accident was entirely caused by the other driver, too, which is why she received an insurance settlement the following year at 16 years old. Additionally, generous members of her community donated approximately $35,000 towards her medical bills, and she attended rehabilitation at top-of-the-line hospitals located out of state. Her grandparents even donated close to $15,000 to the rehabs.

“Since then, my parents paid for my college with a 529 plan already established long before I was paralyzed. Thanks to the great medical care and college, I now live independently, work a decent job, and can afford all my bills for now,” she said.

However, the details surrounding her settlement have been fishy for years. Apparently, because the at-fault driver in the accident was an individual instead of a company, her parents opted not to sue them and just took a settlement through auto insurance. Still, her parents have continuously “changed their story” about the resulting funds.

Initially, they claimed that the entire settlement, including some money that wasn’t for her, would be going into an investment account. Then, she’d be able to access it at her parents’ discretion if she required medical care.

But then, a few years later, her parents made a suspiciously large purchase. When she was 19, and her brother was only 17, her parents actually bought another house down the road, meant for her brother to live in.

“My dad did it sort of impulsively, but they justified to me saying they had spent a lot of money on my medical bills, and it wasn’t fair that my younger brother hadn’t received as much time, money, or attention out of the whole ordeal,” she recalled.

“They rented it out for four years at a loss while my brother was in school.”

Sign up for Chip Chick’s newsletter and get stories like this delivered to your inbox.

At the same time, she graduated from college and relocated to a new state right afterward. Since then, she has been paying her bills completely on her own.

More recently, though, suspicions about her settlement have cropped up again. That’s because her brother, who lived in the house for one year, is now moving back in with their parents. Why? Well, her parents never actually intended to just give him the house for free. Rather, they expected him to pay back the mortgage, which he is simply unable to do.

This pushed her to believe that all the settlement funds had been spent already. Nonetheless, about a week ago, her mom claimed to have “discovered” another medical account, so she could ask them for reimbursement whenever she needed medical supplies.

At that point, she asked if she could control the money herself. She wanted to, first of all, know how much was in the account, and secondly, invest it.

That’s when she learned that her parents’ financial advisor supposedly told her parents to put the entire tax-free insurance settlement for her whole family in her mom’s universal life insurance policy. Her parents stated they didn’t know how much money was in there, and they were going to give her $10,000 per year for her medical bills.

But the real kicker? They said that, after they passed away, they were going to put her younger brother in charge of distributing her settlement money to her!

‘When I asked why they hadn’t been doing that for the past few years, they claimed I was ‘financially irresponsible,'” she revealed.

“My credit score is over 750, I have lived on my own since age 21, I’ve never missed a payment, I religiously track all expenses and income on spreadsheets, I’ve never carried a balance on my credit card, and my partner and I have a net worth of over $40,000.”

She realizes that, in theory, her financial situation could be “better.” Even so, she knows that she’s never given anyone in her family a reason to think that she’s irresponsible with money.

Regardless, she was thrilled about receiving $10,000 a year at first, until her partner became suspicious and pointed out that her parents had repeatedly switched their story about the money. This led her to do some research and uncover that her parents were appointed as guardians by the court to manage her settlement, valued at $130,000, until she was an adult.

As for her brother, he received a settlement worth $30,000. And the total amount for both her and her brother was combined in her parents’ investment account instead of just a trust for her.

Now, she doesn’t really trust her parents anymore and wants to speak to both them and their financial advisor so they can “correct their errors in the most tax-advantaged way possible.”

“I plan to ask them to transfer me the $130,000 plus any unrealized capital gains that have accumulated over the past seven years,” she explained.

“Considering the average performance of the S&P 500 over the past seven years, that $130,000 should have more than doubled, and the $10,000 per year they promised would still allow them to profit off of my own insurance settlement for my spinal cord injury.”

She’s finished leaving her settlement in her parents’ hands because she doesn’t believe they truly have her best interests at heart. And once she has control of the funds, she intends to invest it in a Roth IRA due to the fact that she’ll inevitably grow older as a wheelchair user and incur more medical expenses.

But obviously, it’s a very real possibility that her parents will not voluntarily hand over the money. So, she’s currently wondering whether she could pursue legal action and have a “decent” case against them. Finally, she is also unsure whether asking for her settlement money as a lump sum is justified, given the circumstances.

Does it sound like she needs to hire a lawyer? Would you trust your parents with your settlement money if they kept changing the details like this?

You can read the original post below.

More About:Relationships